36+ how is a reverse mortgage paid back

One of the easier ways to get out of a reverse mortgage is to sell the house and use the proceeds from the sale to pay off the loan. How Do You Pay Back A Reverse Mortgage Banks Com What Is A Reverse Mortgage How Does It Work.

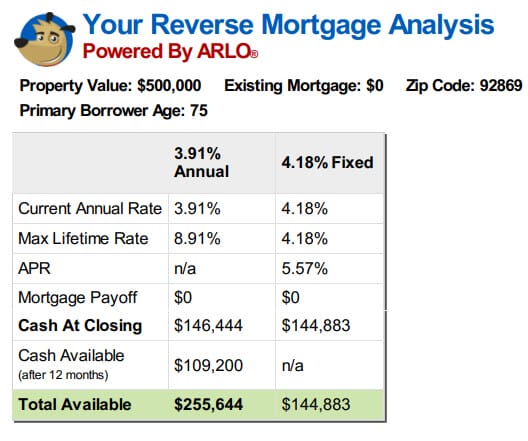

Reverse Mortgage Calculator

Ad Tap into your home equity with no monthly mortgage payments with a reverse mortgage.

. Web A reverse mortgage is a loan that allows homeowners who are 62 or older borrow against a portion of the equity in their home. Proceeds from a reverse mortgage loan are usually tax. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works.

AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees. Web Option 3. Web A reverse mortgage can be an expensive way to borrow.

PLEASE TURN OFF YOUR CAPS LOCK. Then the reverse mortgage lender pays you either with monthly payments a lump sum or. Take out a new mortgage.

A reverse mortgage works. The proceeds of the sale usually satisfy the loan even if the reverse. Please avoid obscene vulgar lewd racist or sexually-oriented language.

Search Now On AllinsightsNet. You are fully responsible for. Web You can deduct mortgage interest on the first 750000 of the loan or 375000 if youre married and filing separately if you took out the loan before Dec.

Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. Web 36 how is a reverse mortgage paid back Senin 20 Februari 2023 Edit. Web Reverse mortgages often come with high fees and closing costs and a potentially costly mortgage insurance premium.

Dedicated to helping retirees maintain their financial well-being. Web 1 day agoKeep it Clean. Another way to get out of a reverse mortgage is to sell your home.

If the borrowers heirs want to keep the home they can simply take out a new mortgage on the house to pay off the balance of the reverse mortgage. Ad Eliminate Monthly Mortgage. For loans equal to 60 or less of the.

Check Your Eligibility For A Reverse Mortgage. The most common way to repay a reverse mortgage is to sell the home and use the proceeds to pay back the loan. Ad Learn How a Reverse Mortgage Can Help You Strengthen Your Safety Net in Uncertain Times.

Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. See if you qualify. Web A reverse mortgage is a type of home loan for people age 62 or older.

Looking For Reverse Mortgage. Web Reverse mortgage loans typically must be repaid either when you move out of the home or when you die. Ad Free Reverse Mortgage Information.

Web Typically you take out a reverse mortgage on a home you own. The second scenario and what is usually the case with a reverse mortgage is that next of kin pay off the loan after the borrower. Ad Learn How a Reverse Mortgage Can Help You Strengthen Your Safety Net in Uncertain Times.

AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees. Ad Should You Get A Reverse Mortgage On Your Property. Ad Get The Best Estimate Of Your Loan With A Reverse Mortgage Calculator.

Web Refinancing it back into a standard loan will require you to make monthly mortgage payments again explains Mazzara. Millions Of Senior Americans Enjoy Financial Security Through A Reverse Mortgage. Looking For Reverse Mortgage Calculator.

The money you receive from the sale goes toward paying off the loans balance. Web If failing to pay taxes or insurance is the basis for the default here are some options to consider. Compare Pros Cons of Reverse Mortgages.

Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Web You sell your house and you pay back the bank. Web Qualifying for the Reverse Mortgage is easy.

Web One of the upsides of a reverse mortgage is that lenders characteristically dont impose income or credit requirements. Web The most common way a reverse mortgage is paid back is through selling the home. Its for people who have gained equity in their home since originally buying it and likely have.

However you would retain the property as part of. If you can afford to pay your taxes and homeowners insurance do it. First you must be at least 62-years old.

The fees and other costs to borrow money this way can be higher than other alternatives like a home equity loan or. However the loan may need to be paid back sooner if the. If you are married the youngest spouse must be at least 62-years old in order.

Web The simplest way to pay back a reverse mortgage is simply to sell your home. When the home is sold you use the proceeds from the sale to pay back the.

Reverse Mortgage Steps For Early Payoff Goodlife

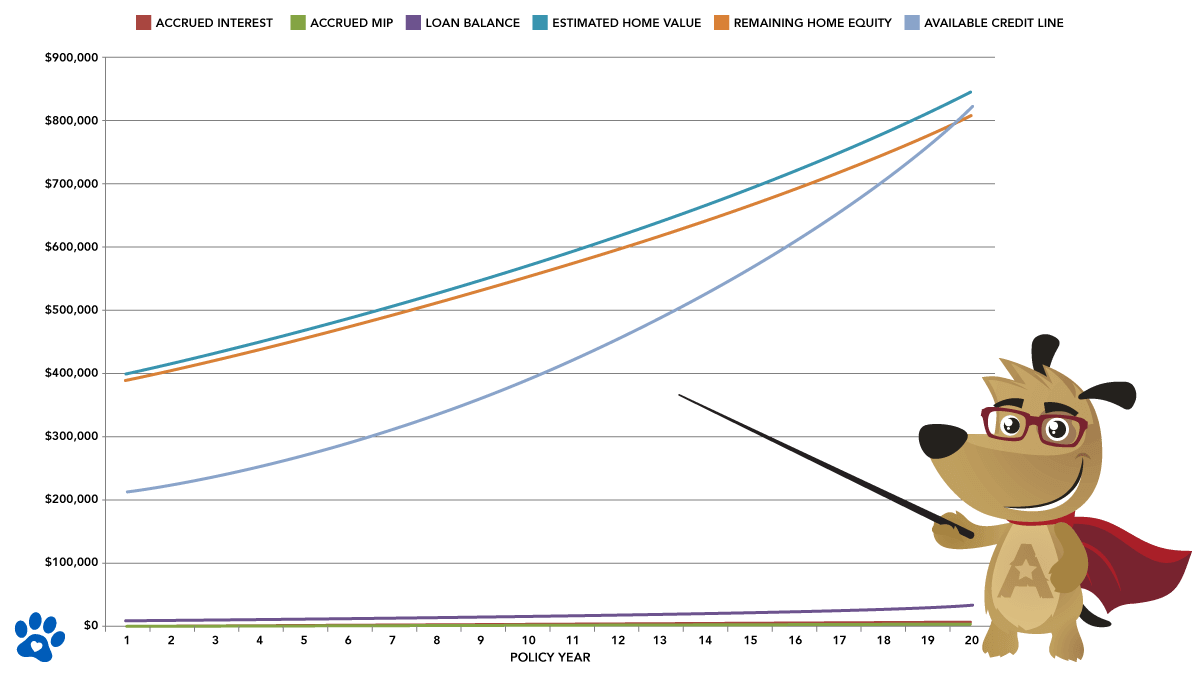

What Is A Reverse Mortgage How Does It Work Arlo

How To Pay Back Reverse Mortgage Bankrate

Inequalities And Environmental Changes In The Mekong Region By Agence Francaise De Developpement Issuu

How Do You Pay Back A Reverse Mortgage Banks Com

Reverse Mortgage Payoff How Does It Work Hcs Equity

What Is A Reverse Mortgage How Does It Work Arlo

Here Are 3 Reverse Mortgage Examples In 2023

5 Best Reverse Mortgage Companies Lendedu

The Most Common Way To Repay A Reverse Mortgage Aag

How Do You Pay Back A Reverse Mortgage Credible

Does Your Reverse Mortgage Need To Be Paid Back Youtube

What Is A Reverse Mortgage How Does It Work Arlo

What Happens At The End Of A Reverse Mortgage

How To Pay Off A Reverse Mortgage Early Step By Step Guide

How Do You Pay Back A Reverse Mortgage Know Your Options

3 Advantages Of Making Interest Payments On Reverse Mortgages